Best Virtual Amazon Seller Conferences To Attend This 2024

Mark your calendar for these upcoming online Amazon Seller Conferences to power up your selling strategies from Q2 and beyond! The world of Amazon selling is constantly evolving. Staying ahead of the curve requires continuous learning and strategic adaptation. Virtual

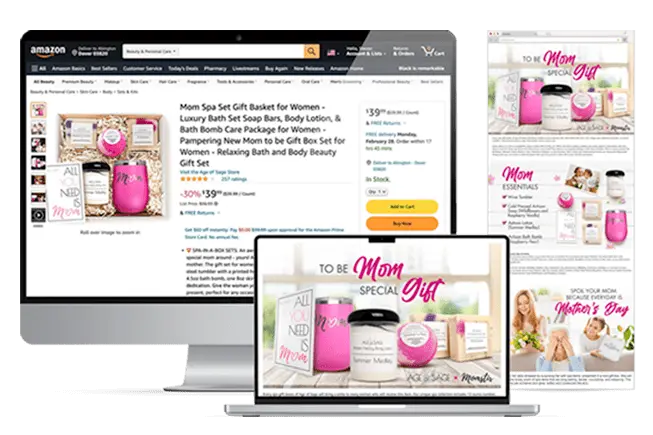

Start Making Sales

Start Making Sales