With recent Amazon Rufus AI updates, the assistant can now remember user preferences, track price histories, and execute auto-buy commands, marking a major evolution that Amazon projects will drive a significant $10 billion revenue lift.

Shoppers often feel overwhelmed by research, comparisons, and unclear product details on large marketplaces. The problem continues to affect purchase confidence across many categories.

Amazon says its latest Rufus AI updates are addressing that gap, reporting a sharp increase in usage of up 149% and linking those interactions to a significant rise in sales.

New Agentic Capabilities and Smart Features Drive Growth

Mike Evans, Robert Derow, Mitch Krogman, and Lia Gregor of Boston Consulting Group"The rise of AI shopping agents represents a seismic shift in global commerce, delivering customers who are 10% more engaged and arriving further down the sales funnel with a stronger intent to purchase."

Amazon has implemented over 50 technical enhancements to transform its assistant into a more proactive and intelligent system. These Amazon Rufus AI updates leverage a mix of advanced models, including Anthropic’s Claude Sonnet and Amazon Nova, to handle complex reasoning and multi-step tasks.

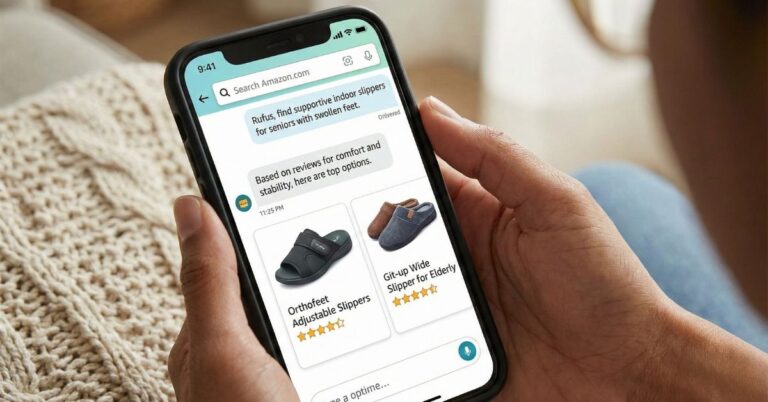

For those asking what is Amazon Rufus, it has evolved beyond a simple search bar into a knowledgeable companion that uses Retrieval-Augmented Generation (RAG) to pull insights from trusted publishers like The New York Times and Vogue. This allows the Amazon AI shopping assistant to answer broad questions about trends or specific inquiries about product specs with high accuracy.

The system now features long-term memory to provide a highly personalized experience based on past interactions and stated preferences. Acting as a dedicated Amazon personal shopper AI, it recalls details such as a user’s pet breed or children’s ages to automatically surface relevant gift ideas and highlight specific product attributes.

Users can interact with the tool through text or leverage Amazon voice search updates to command the assistant to reorder past items or find completely new products. Among the most impressive Amazon new AI features is the ability for iOS users to snap photos of handwritten grocery lists, which the AI analyzes to populate a digital cart instantly.

Key capabilities introduced in this update include:

- Agentic Auto-Buying – Prime members can set price targets, and the assistant will automatically purchase the item when it hits that price, saving users an average of 20%.

- Visual and Contextual Search – Shoppers can upload images for advice, such as removing stains from a rug, or search by occasion, like planning a “Frozen-themed birthday party.”

- Price Transparency – A new 30-day and 90-day price tracker helps customers evaluate deal quality immediately within the chat interface.

- Expanded Inventory Access – The tool can now surface products from non-Amazon merchants, offering a “Shop Direct” button that guides traffic to external websites.

- 24/7 Customer Service – The AI handles post-purchase support, including order tracking, returns, and account settings, without human intervention.

What Sellers Must Consider With Amazon Rufus AI Updates

Amazon Rufus AI Updates are changing how customers research, compare, and buy products, which means sellers need to rethink visibility and discoverability. Shoppers can now ask highly specific questions, compare items in their carts, and find deals, making product content accuracy more critical than ever.

The AI assistant enables users to search for products by purpose, event, or use case, highlighting the importance of detailed listings and clear benefits. Sellers should ensure titles, bullets, and descriptions address common questions such as durability, usability, or specific product features.

Rufus also allows customers to track prices, set alerts, and auto-buy items when they reach target prices. Sellers must monitor pricing strategy closely and consider promotions that align with AI-driven price alerts to stay competitive.

With the ability to reorder favorites or restock frequently purchased items, Amazon’s personal shopping AI is streamlining repeat purchases. Brands can optimize subscription options and maintain inventory levels to capture repeat business efficiently.

Visual and image search features are also growing in influence, letting customers find products through photos or specific styles. Sellers should ensure product images are high-quality, showcase multiple angles, and align with common visual queries to appear in AI-driven search results.

Key Action Steps for Sellers:

- Review and enhance product listings for clarity and detailed specifications

- Monitor pricing and offer competitive deals for AI-driven auto-buy and alerts

- Optimize images for visual search and specific use cases

- Prepare inventory for repeat purchases influenced by reorder and restock features

- Consider FAQs and Q&A content that answers likely AI-generated shopper questions

By adapting to how Amazon Rufus AI interacts with buyers, sellers can protect visibility, increase conversions, and take full advantage of AI-driven shopping behaviors.

$10 Billion Revenue Projection and Strategic Infrastructure Shift

According to Dave Smith’s article on Fortune, Amazon has attached a concrete dollar figure to its artificial intelligence investments, estimating that the assistant is on pace to generate an additional $10 billion in annualized sales. This significant Amazon Rufus sales impact was disclosed during the company’s third-quarter earnings call, where executives noted that monthly active users have grown 140% year over year.

The retailer reported that customers who engage with the assistant during their shopping journey are 60% more likely to complete a purchase compared to those who do not. These impressive Amazon Rufus conversion rates validate the company’s decision to embed the tool directly into the mobile app and website to guide complex buying decisions.

A primary strategic goal of the deployment is to retain user traffic within Amazon’s ecosystem rather than losing high-intent research queries to external competitors. This aggressive positioning of Amazon Rufus vs Google search aims to train consumers to rely on the retailer for product education and discovery rather than just the final transaction.

The projected revenue figures are calculated using a metric called “downstream impact,” which utilizes a seven-day rolling model to attribute sales to specific AI interactions. This methodology captures value even when immediate purchases do not occur directly after Amazon Rufus price tracking requests or product inquiries, accounting for delayed consumer decision-making.

Internal documents indicate that the tool is projected to contribute over $700 million in operating profits this year, partly driven by advertisements embedded within the conversational responses. This Amazon Rufus revenue growth is expected to accelerate further, with internal targets set for $1.2 billion in profit contributions by 2027.

To support these Amazon Rufus AI updates, the company has raised its 2025 capital expenditure forecast to $125 billion, directing funds toward massive infrastructure projects like the new $11 billion Project Rainier data center. This pivot toward AI-driven efficiency coincided with the elimination of approximately 14,000 corporate roles, a restructuring move aimed at reducing organizational layers while accelerating technical innovation.

Key Financial and Operational Metrics:

- Projected Sales Lift – $10 billion in annualized incremental sales attributed to the AI assistant.

- User Engagement – 250 million users in 2025, with interactions up 210% year over year.

- Ad Revenue -Advertising revenue climbed 22% to $17.6 billion in Q3, supported by new ad inventory sources.

- Infrastructure Investment – $11 billion committed to Project Rainier for training Anthropic models and deploying 1 million Trainium2 chips.

- Attribution Model – Uses a 7-day rolling window to track sales resulting from AI interactions, ensuring credit for delayed conversions.

New "Researched by AI" Feature Prioritizes External Authority

According to a recent observation shared in Leo Sgovio’s LinkedIn post, Amazon has quietly introduced a “Researched by AI” section that appears at the very top of mobile search results. This new module cites third-party publications, such as GamesRadar+ and Your Teen Magazine, positioning external editorial content above traditional product listings.

This development suggests that the latest Amazon Rufus AI Updates are designed to prioritize off-site topical authority over simple on-page keyword optimization. By elevating data from trusted publishers, Amazon is signaling that it now places higher trust in independent external reviews than in the claims made on a seller’s own product page.

For sellers, this creates a new competitive dynamic where standard listing optimization is becoming commoditized. The real competitive moat is shifting toward securing mentions in niche industry publications and authoritative blogs that the AI uses to inform its buying recommendations.

Rising Adoption Meets Consumer Skepticism and Trust Barriers

According to Rob Lenihan, Senior Reporter at The Street, Amazon is facing stiff competition from retailers like Walmart and Target, who are deploying their own tools named Sparky and the AI Gift Finder, respectively.

This competitive surge aligns with Adobe data showing that traffic from generative AI sources skyrocketed by 1,300% during the 2024 holiday season compared to the previous year.

On high-traffic days like Cyber Monday, engagement with these tools surged nearly 2,000%, indicating that shoppers are increasingly using Amazon Rufus for research and deal discovery.

Despite this volume, conversion rates for AI-driven traffic still trail behind traditional channels like email and paid search, though the gap is quickly narrowing as users get more comfortable buying directly through chat.

However, the recent Amazon Rufus AI Updates face a critical challenge regarding consumer trust, as vocal users on platforms like Reddit have criticized the assistant for hallucinating details or merely reciting product descriptions.

Any experienced Amazon agency will tell you that this skepticism makes accurate, high-quality listing data more critical than ever to prevent AI errors.

A YouGov survey highlights that over half of consumers remain uninterested in AI assistants, with 45% explicitly preferring human interaction over automated support. To counter this resistance, forward-thinking brands are applying Amazon off-site SEO tips to ensure their products are validated by the trusted external publishers that Rufus references.

Privacy remains a significant friction point, with one-third of shoppers citing data security concerns as their primary reason for avoiding these tools. Navigating these complex demographic divides, where Gen Z adoption is high while others remain hostile, is rapidly becoming a fundamental chapter in any comprehensive Amazon Rufus seller guide.

Key Consumer Sentiment and Adoption Statistics:

- Explosive Traffic Growth – Generative AI traffic increased 1,300% year-over-year during the holidays, with a 1,950% spike on Cyber Monday.

- Planned Usage – Approximately 52% of consumers plan to use AI tools this year for tasks like creating shopping lists and finding gifts.

- Accuracy Concerns – About 25% of users worry that AI recommendations will be factually incorrect or misleading.

- Upselling Fears – 30% of respondents believe the AI will prioritize upselling unnecessary items rather than finding the best fit.

- Preference for Humans – A significant 45% of shoppers still prefer human assistance for customer service and shopping advice.

- Skepticism – More than 50% of surveyed consumers stated they have no interest in using an AI shopping assistant at all.

Amazon Shopper Report 2025 by Remazing"Worldwide, 73% of online shoppers remain unaware of Rufus, with U.S. familiarity reaching only 33% compared to just 20% in France."