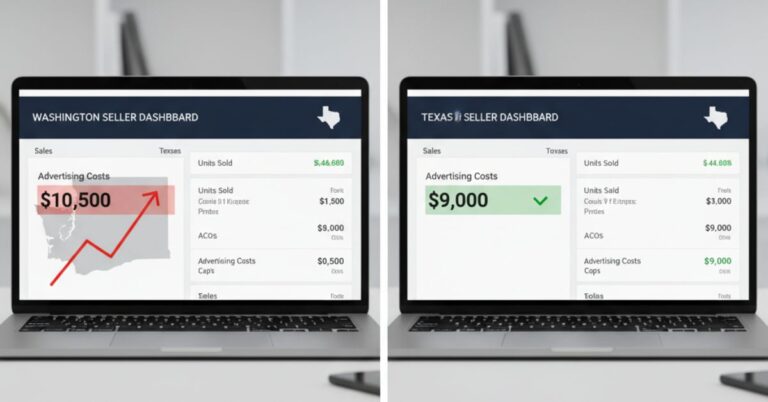

Starting October 1st, Washington's new sales tax on Amazon ads will go into effect, creating a significant financial burden and competitive disadvantage for an estimated 50,000 to 100,000 sellers in the state.

Running a profitable Amazon business requires a substantial investment in advertising. Now, Washington-based sellers face an additional, state-mandated cost on those essential ad services.

Considering average sellers spend nearly $300,000 daily on ads, this new sales tax is a major operational threat. The move leaves local sellers at a clear disadvantage against competitors in other states, forcing them to either absorb the cost or find a new way to do business.

Read on to understand the full scope of this tax and how sellers can prepare before the deadline.

Washington State’s New Sales Tax on Amazon Ads

Stephen P. Kranz, Mark Nebergall and Jonathan C. Hague - McDermott Will & Schulte"Taxing their (digital ads) sale introduces tax pyramiding and adds costs that will ultimately be passed on to consumers. For Washington’s tech-driven economy, this change will inflate prices and reduce competitiveness."

Starting October 1st, Amazon sellers with a business address in Washington will face a new sales tax on their advertising services. The legislation, signed into law on May 20th, is set to impact an estimated 50,000 to 100,000 sellers within the state.

The new law specifically targets online advertising services while leaving traditional media untouched. Businesses will pay sales tax on their Amazon ads regardless of the geographical location they are targeting.

- Taxable Services – All online advertising, including Amazon ads.

- Exempt Services – Newspapers, radio, television broadcasting, billboards, and transit advertising.

The Impact on Seller Competition

This tax creates a significant competitive disadvantage for Washington-based businesses, adding another financial burden on top of already rising ad costs. The added expense creates a higher barrier to entry for new entrepreneurs and reduces the competitive position of existing small businesses in the state.

The legislation has sparked broader market concerns that it could set a precedent for other states. A successful implementation in Washington might encourage similar measures elsewhere, creating a complicated patchwork of state-specific advertising taxes for sellers.

Potential Workarounds for Sellers

Impacted sellers are not without options and are already evaluating strategies to mitigate the financial strain. Noah Wickham, VP of Sales and Marketing at our Amazon agency, shared in a recent YouTube video that several legal workarounds are available.

Sellers can consider the following options to maintain compliance while avoiding the new tax:

- Virtual Address – Obtain a virtual business address in a tax-friendly state like Delaware and update the legal entity information in Amazon.

- LLC Restructuring – Establish a new LLC in a business-friendly state, such as Delaware, and transfer the Amazon business operations to that new legal entity.

How Washington’s Sales Tax on Amazon Ads Will Be Applied

The Washington Department of Revenue will calculate sales tax on the final sale price of each advertising service. The amount collected varies depending on product type and the business address on file.

For accounts billed at the Manager Account level, the tax location is tied to the billing profile address. For Advertiser Account level billing, the advertiser’s billing address determines the tax location.

Final invoices will show the sales tax as a separate line item. This ensures sellers see the exact cost applied to their advertising services.

In its advertising resource articles regarding the new Washington State Sales Tax, Amazon explained the exemptions available to eligible businesses. Companies may avoid the tax if they provide valid certificates such as:

- Reseller certificates – for agencies or resellers purchasing ad services to resell to advertisers.

- Multiple points of use (MPU) – for businesses that use ad services across multiple jurisdictions.

Exemptions remain valid until the submitted certificate expires. Sellers must provide updated documentation before the expiration date to keep their exemption active.

Other Major Sales Tax Changes Coming October 1st

The new tax on digital ads is part of a much larger tax overhaul impacting businesses across the state. As explained by Abella Tax Services, other important sales tax changes in Washington State also start October 1st, affecting industries that were previously tax-free.

This expansion means that companies will face new costs not just for advertising, but for a wide range of essential operational services. The following sections break down the key industries affected by the new legislation.

Information Technology (IT) Services

Information technology and digital development services will now be subject to sales tax for the first time. This change covers a broad range of common business support operations.

- Taxable IT Services Include – Help desk support, network services, data processing, payroll services, custom software development, and website design.

- Key Exemptions – Website hosting and domain name registration will remain non-taxable.

Security Services

The security industry also faces new tax requirements across most of its service offerings. Both personal protection and commercial security operations will be impacted.

- Taxable Security Services Include – Security guards, personal and event security, security system monitoring, and background check services.

- Key Exemption – Locksmith services are a notable exception and will remain exempt.

Temporary Staffing Agencies

Businesses that rely on temporary staffing agencies will see a significant increase in their operational costs. This change is expected to be one of the most expensive for companies that depend on a flexible workforce.

Live Educational Presentations

The sales tax is also being applied to paid live educational and training events. This affects any paid workshop, class, or seminar where a presenter and audience exchange information in real-time, either in person or online.

A Guide to Washington's New Tax on Live Presentations

With live sessions affected by the upcoming digital sales tax implementation, Abella Tax Services also published a guide from which direct-to-consumer companies and e-commerce brands can learn.

This guidance addresses how businesses conducting paid webinars, workshops, and online classes must collect and remit sales tax. The rules apply to any live session with a presenter and multiple attendees where information is exchanged in real-time.

Not all educational content is taxed, with key differences between live group sessions and other formats. Free presentations and one-on-one sessions are notably exempt.

- Taxable Activities – Paid marketing workshops, business education classes, professional development seminars, and group classes like cooking or art instruction.

- Exempt Activities – One-on-one consulting, private tutoring sessions, music lessons, and pre-recorded online courses purchased for later viewing.

Businesses must follow specific procedures for collecting the tax based on the event’s format. For in-person events, the sales tax rate of the event’s physical location must be charged.

Remote online presentations have more complex requirements, as businesses must collect sales tax based on each ticket purchaser’s individual address. Companies without systems to capture buyer addresses should default to using their own business location’s tax rate.

For filing, businesses must report total revenue broken down by purchaser locations, using separate line items for different cities. The state provides online tools to look up the correct local sales tax rates for accurate reporting.

Broad Scope of Washington’s Ad Tax Raises Questions

With the October 1st deadline just days away, legal and marketing experts are sounding the alarm over the new law’s broad scope and unclear implementation. In her Marketing Brew article, Jasmine Sheena discussed the concerns and qualms of businesses facing this imminent change.

A key part of the legislation reclassifies digital advertising from an automated service to a standard retail transaction. This subjects services from graphic design to search engine marketing to the state’s full retail sales tax.

Disproportionate Impact on Small Businesses

The tax will affect all businesses, from small local shops to large corporations like Amazon and Microsoft. However, experts believe small businesses may face the greatest compliance challenges due to a lack of infrastructure and resources.

This added burden is expected to reduce marketing budgets, as businesses will have less to spend on advertising itself. Some strategists believe this tax will ultimately encourage businesses to move their operations out of Washington entirely.

Significant Legal and Privacy Hurdles

The new law faces several potential legal challenges and raises significant data privacy questions. Other states are watching closely to see how these issues play out.

- Federal Law Violations – The law may violate the federal Internet Tax Freedom Act (ITFA), facing legal arguments similar to those used against a digital ad tax in Maryland.

- National Precedent – Many other states, including California and New York, are closely watching the outcome in Washington as they consider similar legislation.

- Data Privacy – The need to collect location data for tax purposes could potentially conflict with existing privacy laws, such as Washington’s My Health My Data Act.

C. Michael Kvistad, Washington State Business and Real Estate Lawyer"These services will be taxed at the state’s standard retail sales tax rate of 6.5%, plus any applicable local rates."