The launch of Amazon Manufacturing Central creates a critical dilemma for sellers, promoting streamlined sourcing from India just as new 50% US tariffs make that country a high-cost, high-risk option.

Nearly all retailers can gain significant efficiency by refining their supply chain. For Amazon sellers, this means better control over fulfillment and returns, which is crucial for protecting margins.

Amazon’s launch of Manufacturing Central, a portal for Indian factories, is a major development in this area. It offers an end-to-end production pipeline that promises to simplify operations for sellers.

However, this new venture collides directly with escalating trade tensions. The new US tariff on Indian goods raises a critical question: Is this the supply chain solution sellers need to survive, or does it lead directly into a trade war?

What Is Amazon Manufacturing Central and How Does It Work?

Chris Turton"Amazon MFC will allow brands to source and work directly with manufacturers in India. The question for brands ultimately is whether or not they are prepared to trust Amazon in knowing its manufacturing process, designs and costs."

Amazon’s latest move toward deeper control of the supply chain could reshape how sellers manage inventory, fulfillment, and costs. Noah Wickham, our Amazon agency’s VP of Sales and Marketing, recently shared an important update about Amazon’s push toward tighter supply chain oversight and what it means for sellers preparing for the future.

This move confirms earlier predictions that Amazon sought deeper visibility into seller sourcing costs. The program’s initial focus on India reveals a clear strategy to navigate global trade tensions.

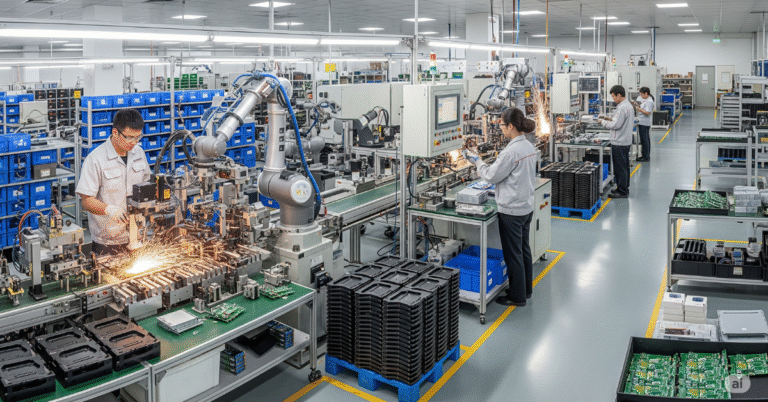

Manufacturing Central currently excludes major production hubs like China, Vietnam, and South Korea. This strategy appears designed to sidestep ongoing tariffs targeting Chinese goods while streamlining logistics.

The platform functions as an end-to-end service for sourcing and production. Sellers can manage the entire process from product design to final shipment through the Amazon ecosystem.

The portal allows sellers to perform several key actions:

- Search a directory of Amazon-approved Indian manufacturers.

- Request and compare quotes from multiple factories.

- Manage product design and customizations directly.

- Ship finished goods into Amazon’s fulfillment network.

Initially, Amazon is targeting specific product categories for the program. These include apparel, furniture, home décor, kitchenware, luggage, and office products.

The platform presents different opportunities and risks depending on a seller’s business maturity. Newcomers may find clear benefits, while established brands face strategic threats.

For new sellers, the program offers:

- Direct access to vetted factories without prior sourcing experience.

- A complete service from product design to FBA delivery.

- A faster process for launching new products on the marketplace.

Experienced sellers, however, should consider several risks:

- Giving Amazon direct access to proprietary designs and cost data.

- The potential of competing with an Amazon-branded version of their own product.

- A reduction in business independence by relying on Amazon for manufacturing.

Data Risks and Supply Chain Control

In a recent analysis, Rutger Wismeyer wrote on LinkedIn about the strategic implications of Amazon’s new program. He describes Manufacturing Central not as a simple sourcing shortcut, but as the final link in Amazon’s end-to-end supply chain.

Before this launch, Amazon already managed most of the logistics and sales process for its sellers. This control extended from international shipping all the way to a customer’s doorstep.

Amazon’s ecosystem already includes services to:

- Ship goods from factories via Amazon Global Logistics and Amazon Freight.

- Store inventory in its FBA fulfillment centers.

- Sell products on the Amazon Marketplace.

- Deliver orders to customers via Amazon Logistics.

With the new portal, Amazon now gains visibility into the “first mile” of the process. This includes the direct relationship between a seller and their manufacturer.

Using the platform provides Amazon with more than just matchmaking data. Sellers are effectively showing Amazon a detailed playbook of their business operations.

This shared data can reveal:

- Which specific factories can produce a successful product.

- A seller’s potential cost structure and profit margins.

- Which product niches are profitable enough for Amazon to enter.

The primary risk is that Amazon, or one of its private label partners, could use this supply chain playbook to launch a competing product. This would be done with full knowledge of a seller’s manufacturing advantages.

The analysis concludes with a key rule for brand owners. Sellers should protect their Cost of Goods and supplier information as closely as they protect their own customer lists.

Ultimately, sellers are advised to be cautious when sharing business intelligence. Never provide a platform with more data than what is essential for it to perform its basic function.

Tariffs Add a New Variable to India Manufacturing

According to a CNBC report, recently announced U.S. import tariffs are expected to have only a marginal downside effect on India’s overall economic growth. Economists attribute this to India’s diversified trade relationships across multiple regions.

However, certain sectors remain more vulnerable to U.S. tariff impacts than others. Apparel, textiles, gems and jewelry, and select chemical products are among the categories most exposed.

These affected industries could receive targeted support measures from the Indian government to offset potential losses. Such interventions may help stabilize production costs and maintain the competitiveness of Indian manufacturers.

A Harsher Outlook for Indian Exporters with 50% Tariff

While some economists predicted a mild impact, a report from DNAIndiaNews suggests the 50% tariff on Indian goods could hit the country’s manufacturing sector hard. The U.S. has now imposed one of the steepest import penalties in the world on India.

The trade penalties escalated quickly in August. The total 50% duty is the result of two separate 25% increases imposed just weeks apart.

- August 7, 2025 – A 25% tariff on Indian imports takes effect.

- August 27, 2025 – An additional 25% is added, bringing the total to 50%.

The White House cited India’s continued oil and military equipment purchases from Russia as the reason for the penalties. Washington frames these purchases as economic support for Moscow.

The new tariff directly impacts a wide range of goods. Many of these are key categories for Amazon sellers sourcing from India.

- Textiles and clothing

- Gems and jewelry

- Shrimp

- Leather and footwear

- Chemicals

- Electrical and mechanical machinery

For some products, the impact is even steeper when factoring in other penalties. For example, Indian shrimp will face a combined 58.26% duty after August 27th.

Trade analysts warn this could lead to factory slowdowns, layoffs, and reduced purchasing power in India. Small and mid-sized manufacturers that rely on U.S. orders face the greatest risk of failure.

Tariffs Push for US Manufacturing Amid Global Shifts

A fact sheet from The White House states these tariffs are intended to re-shore manufacturing and drive economic growth for the American people.

This policy serves as a direct encouragement for sellers and brand owners to move their supply chains to the United States. The administration’s stated goal is for American companies to manufacture their products locally.

The Reality of US Manufacturing

While the government encourages a shift to domestic production, recent industry data presents a mixed picture of the U.S. manufacturing landscape. According to a PracticalEcommerce report, overall activity showed a modest improvement in June 2025.

This data comes from the Institute for Supply Management, whose Purchasing Managers Index rose to 49.0 in June, surpassing forecasts. The index is a key economic indicator based on new orders, production, and other factors from over 400 industrial firms.

However, significant challenges remain, particularly with rising expenses. A July 2025 survey from the Federal Reserve Bank in Philadelphia found that most manufacturers expect operational and labor costs to increase throughout the year.

This sentiment is echoed by the National Association of Manufacturers (NAM). Its Q1 2025 survey identified rising costs and trade uncertainties as the leading concerns for manufacturers across all 50 states.

In response to these pressures, the industry is increasingly focusing on adapting through technology. The NAM survey also revealed that over a third of firms plan to moderately prioritize the digital transformation of their operations in the coming year.

BRG“A full-scale reshoring of U.S. manufacturing is unrealistic, but targeted reshoring focused on strategic industries, backed by robust industrial policy, and supported through friendshoring can strengthen supply chain resilience.”