For American brands, competing with Chinese sellers has become a matter of strategic positioning, leveraging brand quality and customer service to generate more than double the average revenue despite being outnumbered on Amazon's marketplace.

That decision reshaped the economy, hollowing out domestic manufacturing and sending millions of jobs overseas.

Now, the situation has flipped again. Chinese manufacturers no longer need American distributors – they’re selling directly to consumers on Amazon, creating new pressure for US brands trying to stay profitable.

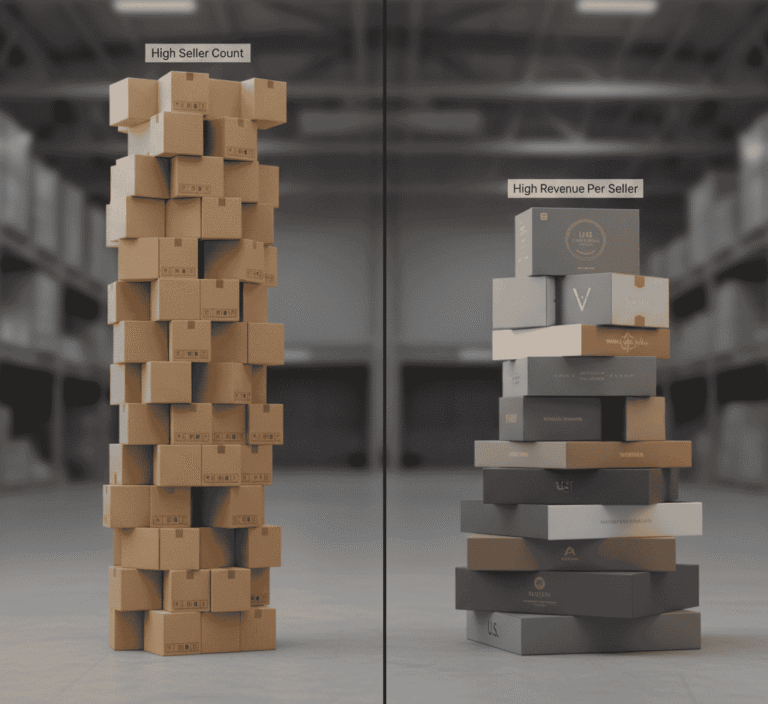

Chinese Sellers Win by Numbers, US Brands Win by Revenue

Arthur Cheung, Pattern’s General Manager in China"Selling price is not the only consideration to buy product, but also the service, the quality, the brands, etcetera,”

Ben Donovan wrote in his article on Marketplace Pulse China Reaches Global Majority on Amazon that Chinese sellers now make up 50.03% of Amazon’s global active seller base. It marks the first time they’ve crossed the 50% threshold across all of Amazon’s international marketplaces, signaling a major shift in marketplace dynamics.

This milestone reflects a decade-long reversal in new seller registrations. In 2015, Chinese sellers accounted for just 7.1% of new Amazon.com accounts, while US sellers held 70.6%. By 2024, those numbers had flipped, with Chinese sellers representing 62.3% of new registrations compared to 26.8% from the United States.

Chinese sellers have achieved majority presence across nearly every Amazon marketplace, except Japan. Their rapid growth continues despite trade tensions and logistical barriers that once limited cross-border competition.

Several factors explain this rise.

- AI-driven tools now automate translation, listing optimization, and image creation, allowing Chinese sellers to tailor content for Western buyers.

- Amazon’s Creator Studio further reduces the creative gap, offering professional-level listing assets even for non-native English speakers.

- Manufacturing proximity and direct factory access let Chinese sellers cut costs and remove middlemen.

- Government export subsidies give additional pricing flexibility in an already cost-sensitive environment.

These combined advantages allow Chinese sellers to offer lower prices while maintaining competitive margins. The result is a flood of affordable listings that appeal to global shoppers seeking value.

Despite being outnumbered, American sellers continue to outperform in revenue. Marketplace Pulse estimates that US sellers generate roughly $157 billion of Amazon’s $305 billion third-party GMV, compared to $132 billion for Chinese sellers.

On average, an American seller earns $884,958 per year, more than double the $393,557 average of a Chinese seller. Globally, the pattern remains consistent, with Chinese sellers holding the majority in count but capturing only 39% of total third-party revenue.

The numbers reveal a clear divide between volume and value. While Chinese sellers dominate by quantity, US brands lead in revenue efficiency, product quality, and long-term brand equity.

Chinese Sellers Expand Beyond Amazon

It is not just on Amazon where the number of Chinese sellers is skyrocketing. Earlier this year, Mitchell Parton wrote in her Modern Retail article that the number of China-based sellers on Walmart’s third-party marketplace has skyrocketed.

In 2021, Walmart opened its marketplace to international sellers, following Amazon’s model of global expansion. That change invited a surge of Chinese merchants, who have since become one of the fastest-growing seller groups on the platform.

Between 2023 and 2024, the number of China-based sellers on Walmart’s marketplace doubled from fewer than 25,000 to around 50,000, according to Marketplace Pulse data. Chinese sellers now make up about 28% of Walmart’s total active sellers, up from 20% the year before.

This rapid rise mirrors trends seen on Amazon, where Chinese sellers already account for more than half of active marketplace participants. The expansion has increased competition for US-based sellers, particularly in price-sensitive categories.

Walmart is adopting several elements of the Amazon flywheel to drive growth.

- More sellers mean more product listings, which boost customer choice and advertising revenue.

- Cross-border shipping pilots allow Chinese sellers to ship products directly into Walmart’s US fulfillment network.

- Lower entry barriers make Walmart an attractive alternative for international sellers seeking new audiences.

These developments could bring new challenges for American sellers. More overseas competition increases the risk of counterfeit or low-quality goods and compresses margins for domestic brands already navigating high inflation and rising fulfillment fees.

At the same time, platform costs continue to climb. Commissions, advertising, and logistics fees on Amazon often consume more than half of a seller’s revenue, pushing some Chinese sellers to test Walmart’s marketplace for additional reach and diversification.

Tariffs on imported goods from China add further pressure to pricing strategies on both sides. Many US sellers still rely on Chinese factories for production, meaning both American and Chinese merchants feel the impact of import costs.

How Chinese Sellers Compete and Where US Brands Still Win

Chinese sellers have found success on Amazon by spending significantly less on advertising than their US counterparts. Instead, they focus on low-cost production, competitive pricing, and rapid product turnover to maintain visibility and attract buyers organically.

Their strategies rely on three core advantages, according to SmartScout’s data analysis:

- Low-cost manufacturing that keeps production expenses minimal.

- Competitive pricing that appeals to budget-conscious shoppers.

- High-volume product launches that fill search results and test market demand quickly.

This model allows Chinese sellers to undercut prices and sustain sales momentum without heavy investment in ads. Many of them play a high-volume, low-margin game—accepting smaller profits per item in exchange for more total sales.

Direct access to factories also gives Chinese brands an edge in cost control. They can introduce new products at lower prices and pressure other sellers to reduce theirs to remain competitive.

Another key strength is their speed and scale in product launches. Instead of banking on a few best-sellers, Chinese sellers release a constant stream of new listings across multiple categories, quickly testing performance and expanding wherever they see traction.

Despite this aggressive strategy, US brands are far from outmatched. Data shows that American sellers generating over $1 million in revenue tend to be larger and more established. Many also operate in categories such as grocery, health, and books, where regulatory barriers limit international competition.

Price wars among Chinese sellers often lead to diminishing returns, reducing profits across entire niches. In contrast, American brands that focus on trust, quality, and long-term customer loyalty continue to thrive – even in markets dominated by lower-priced products.

In short, while Chinese sellers win on volume, US brands win on value, sustainability, and brand power. The playing field has shifted, but the opportunity remains wide open for sellers who understand where their real strengths lie.

Strategies for US Sellers Competing with Chinese Sellers

To effectively compete with Chinese sellers, U.S. brands should avoid direct price wars. Success lies in focusing on high-quality products, building brand loyalty, targeting less-saturated niche categories, and protecting intellectual property.

Compete on Brand, Not Price

The most effective strategy is to build a brand that customers value for more than just its low cost. This creates a defensible position in a crowded market.

- Emphasize Quality. Offer premium products and excellent customer service to foster trust and loyalty.

- Tell Your Story. Create a reputable brand with a strong narrative that connects with customers.

- Target Niches. Focus on high-end markets or categories like health and grocery with less competition and higher margins.

Defend and Expand Your Brand

Proactively protecting your brand and building a presence beyond Amazon are crucial for long-term growth. This approach secures your business on multiple fronts.

- Use Market Tools. Analyze data to find high-potential, low-competition product categories.

- Protect IP. Trademark your brand and report counterfeit products to Amazon for removal.

- Build an External Presence. Develop an independent website to cultivate a direct audience and partner with an Amazon agency to manage both marketplace sales and off-platform brand building.

Scott Needham, CEO and Founder of SmartScout"How to compete against Chinese Sellers on Amazon? Simple. Don't sell in categories in which they sell."