13-Billion Dollars Raised

Investors are pouring money into the Amazon space. They’re acquiring hundreds of brands and bringing them under one roof, an Amazon Aggregators business.

We’ve seen consolidation in countless sectors historically and the Amazon FBA space is no different. Amazon Aggregators are jumping into the market with large funds bringing high levels of professionalism into the brands they acquire and accelerating their growth. The Amazon Aggregators in turn hope to produce profits for their investors.

The below information can help you better understand who Amazon aggregators are, and how to sell your business to them if you’re interested.

Before exploring the list we must understand a few things.

Amazon FBA Aggregators

Amazon FBA Aggregators

What are Amazon Aggregators looking for?

here are some general criteria your business should meet:

- Registered Brands: Amazon Aggregators look for brand sellers who are selling their own branded/private labeled products or are the manufacturers of the products. If you need a trademark, you can order one from us and complete your brand registry in under 7 days.

- Fulfilled by Amazon: Most Amazon aggregators are purchasing fulfilment from Amazon merchants because they don't want to deal with logistics and because it's easy to qualify for Prime status. Sixty-six percent of the top 10,000 Amazon sellers use FBA, according to Marketplace Pulse.

- Profits and Margins: Each acquirer is different but most require a minimum of $200k annual net profit.* Some require $500k annual net profit.* Most say minimum 15% net margins while others will be okay with 10% net margins but not any lower.

- Number of SKUs: More revenue, fewer SKUs. For example, $1M revenue with 1-2 SKUs is more preferable than $1M sales with 50 SKUs.

- Sales through Amazon: Each acquirer is different. Some ask for a minimum of 80% of sales through Amazon whereas some accept 30% approx.

- Loyal Customers: A loyal customer base is a great sign.

- Niche: Each of the Amazon Aggregators has a different niche interest according to their expertise.

- No Black Hat Tactics: You must never engage in activities that may result in a future deactivation of your account.

- Not a Fad: Amazon aggregators look for businesses with a great future scope that don't look like they'll fade out with time.

Why sell your Amazon FBA business?

Selling on Amazon can be more difficult and time-consuming for most sellers than they had imagined. More than half of Amazon sellers are doing their business as a side hustle and one-third as full-time jobs. Limited resources restrict them from expanding their business, hiring more employees, and improving their marketing strategy/funds. Researchers claim that even for Amazon Sellers who are seeing profits find it hard to manage inventory and the supply chain. Meanwhile, Amazon aggregators are loaded with funds and a professional team.

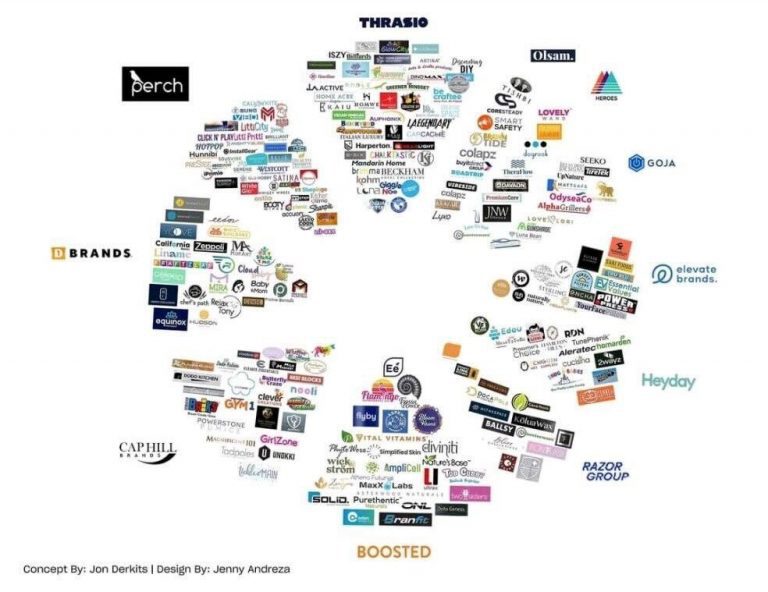

Institutional Amazon Aggregators

Below is a growing list of Amazon FBA business acquirers, or Amazon Aggregators. They have large funds, and are aggressively consolidating brands under one umbrella.

$127-million raised. They buy Amazon FBA businesses and work to build them into world-class consumer brands.

D1 Brands is an Amazon-native team of private label FBA sellers turned aggregators who buy, build, and grow world-class ecommerce brands. They have a 100% close rate on deals and an average closing period of only 27 days. Sellers trust D1 because of their seller roots, and their high-touch, professional exit experience which offers them access to senior leaders at every step of the process. D1 Brands has raised over $123 million in capital.

HeyDay

Built for sellers. They’re building the most seller-centric business on Earth. Tools, resources, capital, insights – Heyday’s here to help the world’s most ambitious sellers thrive. HeyDay has raised more than $800 million in capital.

150+ Million raised, 25+ brands acquired. One of the smoothest acquiring partners My Amazon Guy has worked with. Backed by Target Global, and many other leading investors.

Founded by experts in e-commerce marketing, operations, and strategy—and backed by significant financial capital—Cap Hill Brands is a consumer products company that acquires and operates great brands at scale. We look for long-term businesses with strong competitive advantages. CHB has raised more than $150 million in capital.

Raised over $56 million in capital. The Rainforest team are experienced growth operators in the consumer space and have scaled up multiple successful consumer brands. Our expertise lies in expanding brands through geographical expansion, marketing excellence, omni-channel distribution and increased financial rigour.

Raised over $3.80 million in capital. Benitago is built by Amazon Natives and is for Amazon Natives. Since listing their first private label product on Amazon in 2016, they’ve organically launched and grown 350+ best-in-class products, across 15+ different categories, on Amazon. They are looking to add to their family of brands in the US, UK and EU.

They just recently launched an Aggregator Offer Match Guarantee where they’ll price match any offer from any aggregator and add an additional $250,000. Details can be found here on their website: benitago.com

You put your heart into your business, so we will too. SellerX raised over $767 million in capital. We buy and build Amazon brands. Sell your business fast for the fair deal you deserve. Hand over to our team of e-commerce experts and see the benefits as we grow your business.

Raised over $150 million in capital. Suma was founded on the belief that the next generation of household brands will rise out of the Amazon marketplace, like the namesake the Sumauma tree rises out of the Amazon rainforest. Purpose is to find, acquire and help those brands realize their potential, both in the Amazon “jungle” and beyond.

Trio Media LLC has been riding the wave of internet B2C and B2B growth since 2007. They are a holding company that operates a portfolio of eCommerce brands and invests in technology startups. Recently, grew tired of saying no and began offering limited consulting.

Mantaro Brands is helping shape and accelerate a new era of e-commerce growth by acquiring Amazon FBA brands that are sustainable and inclusive. Their goal is to help brands realize their long-term potential and give business owners the freedom to pursue their next big idea. The Mantaro team, full of seasoned experts, prides themselves on a transparent and efficient buying process. They typically close deals within 30 days.

Highfive Brands