Your ego might not like them, but your bank account will love these 9 Amazon Search Query Performance Report insights.

Amazon gives sellers a mountain of data, but few reports are as powerful as the Search Query Performance (SQP) report. It offers a direct look at the search terms customers use and how your Amazon brand performs for each one.

If you’re an established brand aiming to grow profitably, this report is essential. Studies show using big data effectively can boost operating margins by more than 60%.

TL;DR: Your SQP report is a goldmine for increasing profit margins, but misinterpreting the data is a costly error. This guide breaks down nine actionable insights and the common mistakes sellers make when analyzing them.

For mid-market sellers who need to execute these complex strategies at scale, a dedicated Amazon agency provides the expertise to turn these insights into a cohesive action plan.

Read this article to learn about:

Table of Contents

Your Strategic SQP Partner

You have the data insights; our full-service team has the operational power to execute on them at scale.

Understanding the Search Query Performance Report

The SQP report is the clearest feedback loop between a customer’s search and a seller’s dashboard. It shows what shoppers actually type into the search bar, not what you think they type. A metric on the Amazon Search Query Performance dashboard like “High Impressions, Low Click-Through Rate” is a direct message from the market: “We see your product, but a competitor’s offer is more appealing.”

For mid-market sellers managing larger budgets and product catalogs, this data from the search query performance dashboard is critical. It allows you to make informed decisions that protect your ad spend and strengthen your brand’s visibility.

Using the SQP report as a weekly diagnostic tool can drive your listing optimization and PPC strategy, allowing for continuous adjustments based on real-time market feedback.

Here are nine actionable insights you can pull from the Search Query Performance report to improve your performance on Amazon.

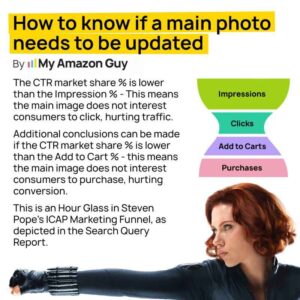

1. High Impressions, Low Click-Through Rate (CTR)

Customers see your product for a relevant search term, but they are not clicking on it. This means your competitor’s product listing appears more compelling on the search results page.

Actions to take

Your main image, title, price, or review count is failing to win the click. Start by analyzing the search results page for the specific query. Then, systematically test changes to the four key elements, such as the main image that appear in search:

- Main Image

A/B test a new main image. Try different angles, add a compelling infographic, or improve the lighting to make the product stand out.

- Title

Revise your title to be more benefit-driven. Make sure the most important keywords are near the beginning.

- Price

Analyze competitor pricing for that specific query. A small price adjustment or the addition of a coupon could make a significant difference.

- Reviews

A low review count or star rating is a major obstacle. If this is the issue, focus on product quality and customer service to improve your rating over time.

Challenges to expect

- A/B testing takes time and high traffic to be valid.

- Quality photos and videos cost money.

- Title changes can hurt ranking if not planned well.

2. High CTR, Low Conversion Rate

Your listing is compelling enough to get the click, but the product detail page is not closing the sale. The problem exists on your page, not on the search results page.

Key insights:

- If your CTR is strong but conversion is poor (under 8%), the issue likely lies with your listing, not your visibility.

- Most listings cap out near 12–15% conversion unless everything is perfectly optimized.

What to do

The issue lies within your listing content. Your goal is to build trust and effectively communicate the product’s value.

- A+ Content

Enhance your A+ Content with high-quality images, comparison charts, and lifestyle shots that address customer questions. Break up large blocks of text to make it easy to scan.

- Product Video

Add a video that demonstrates the product in use, highlights key features, or tells your brand story.

- Bullet Points

Rewrite your bullet points to address customer pain points and desires directly. Use the language you find in your customer reviews.

- Negative Reviews

Analyze your most recent negative reviews. They contain valuable clues about customer objections or missing information that you can address in your listing copy or images.

Challenges to expect

- A+ Content and videos need design skills or budget to outsource.

- It takes time to spot listing issues and write effective copy.

3. Low Impressions, High Conversion Rate

You have found a “hidden gem” keyword. For the few people who use this search term to find your product, it converts exceptionally well. The problem is that not enough people are seeing your product for this term.

Actions to take

This keyword needs maximum visibility. You need to signal to Amazon’s algorithm that your product is highly relevant for this query.

- Title Optimization

Move this high-converting keyword into your product title, preferably near the front. Studies have shown that improving product titles led to a 151% boost in clicks, a 47% jump in CTR, and a 28% drop in CPC.

- PPC Campaigns

Launch a new, high-budget Sponsored Products exact match campaign targeting only this keyword. Monitor its performance closely.

- A+ Content

Build a section of your A+ Content around the specific use case or benefit this keyword describes.

Hurdles to expect

- Targeting new keywords with PPC can be costly at first.

- Low search volume may limit long-term traffic potential.

4. High "Add to Cart" Share, Low "Purchase" Share

Shoppers are interested enough to add your product to their cart but are abandoning it before completing the purchase. This often points to price sensitivity or an unexpected issue at checkout.

What to do

Your goal is to give these interested shoppers a final reason to buy.

- Promotions

Consider running a limited-time coupon or promotion. This can create a sense of urgency and convert customers who were on the fence about the price.

- Shipping Times

Ensure your product is Prime-eligible and has competitive delivery times. A surprisingly long shipping estimate that only appears at checkout is a common cause of cart abandonment.

- Review Your Offer

Double-check your total price, including shipping, against your top competitors. A small difference can be enough to lose the sale.

Possible challenges

- Overusing coupons can hurt margins and brand value.

- Non-FBA sellers may struggle to keep shipping times competitive.

5. Analyzing Your True "Brand Share"

The SQP report shows your brand’s percentage of total impressions, clicks, add-to-carts, and purchases for any search term. This is your true, query-level market share.

Action plan

For a mid-market seller, defending market share is just as important as growing it. Identify your top 5-10 most important, high-volume keywords and monitor your brand share for them weekly.

If you see your share of clicks or purchases declining, it is an early warning that a competitor is becoming more aggressive or effective. Use this insight to increase your advertising pressure, run a promotion, or optimize your listing for that term before you lose significant ground.

Challenges to tackle

- Requires weekly monitoring.

- Regaining market share may need higher ad spend, hurting profits.

- Pinpointing the competitor often needs deeper analysis.

Grow Your SQP Profits

We go beyond keywords to fine-tune your entire sales funnel, turning raw data insights into measurable growth for your business.

6. Identifying Negative Keyword Candidates

The report will show search queries that generate impressions and clicks but have zero purchases. These clicks are wasting your advertising budget.

Steps to take

Add these queries as negative exact match keywords in your Sponsored Products campaigns. This will prevent your ads from showing for irrelevant searches, immediately improving your Advertising Cost of Sales (ACoS) and allowing you to allocate your budget to terms that actually convert.

For example, if you sell “leather dog collars” and get clicks but no sales from the query “vegan leather dog collars,” you should add “vegan” as a negative keyword.

Challenges to expect

- The main challenge is diligence.

- You must review your SQP report regularly to catch these underperforming queries.

- Don’t be too quick to cut: low-click keywords may just need more time or data.

7. Discovering New Customer Language

The SQP report reveals the exact jargon, slang, and long-tail phrases customers use to find your products. This language is often different from the technical terms a brand might use internally.

What you can do

Incorporate this authentic customer language into your listing and advertising.

- Backend Search Terms

Add these newly discovered phrases to your backend search term fields.

- Listing Copy

Weave the terms naturally into your bullet points and product description to improve SEO relevance.

- PPC Strategy

Build new ad campaigns around these long-tail keywords. They are often less competitive and have higher conversion rates.

Problems to expect

- It can be a fine line between incorporating customer language and “keyword stuffing.”

- The language must be integrated naturally into the listing copy to remain readable and persuasive.

Key Insights:

- SQP data is highly accurate, showing real customer search terms straight from Amazon.

- Volume trends reveal new keywords, helping guide listing updates and product ideas.

8. Validating Expansion Opportunities

You might discover that your product is getting impressions and even clicks for a related but distinct product category. This is a signal from the market about unmet demand.

Actions to take

Analyze these queries as potential opportunities for new product variations or complementary products. For example, if your “large dog bed” consistently gets impressions for “orthopedic dog bed,” it may signal a strong market for you to launch an orthopedic version.

This search query performance data provides a starting point for market research, validating an idea with real customer search behavior before you invest in product development.

Challenges

A search query is not a business case. While the SQP report can provide the initial idea, significant further research is required to validate a new product opportunity.

This includes analyzing the competition, sourcing costs, and potential market size.

9. Measuring the "Brand Halo" Effect

The report allows you to see how many purchases for one of your products came from a search for a different product within your brand. For instance, a customer searches for “Brand X shampoo,” clicks on your shampoo listing, but ends up buying “Brand X conditioner” instead.

Steps you can take

- Use cross-sell data to identify products with strong halo effects.

- Create virtual bundles to simplify multi-product purchases.

- Optimize “Frequently Bought Together” suggestions using these insights.

- Leverage findings for brand-focused ad campaigns and catalog engagement.

Possible hurdles

- Bundles must pair logically and be priced competitively.

- Effectiveness depends on customer relevance and value perception.

- “Frequently Bought Together” is algorithm-driven and hard to control directly.

Common Mistakes in Interpreting Amazon Search Query Performance Data

Search Query Performance (SQP) data offers valuable insights, but only if you know how to read it correctly. Misinterpreting this data can lead to poor decisions that waste time, money, and momentum.

Mistake 1: Focusing Only on High-Volume "Vanity" Keywords

A seller downloads their SQP report and immediately sorts by impression volume. They pour their entire focus and budget into the top 5-10 keywords with massive search traffic, like “water bottle” or “yoga mat.”

Why it’s a problem

- High-volume keywords are costly and competitive.

- They drive impressions but usually have low CTR and conversions due to broad intent.

- Ignoring long-tail keywords means missing out on higher-converting, more profitable traffic (e.g., “32 oz insulated water bottle with straw lid”).

Mistake 2: Making Major Decisions on Insufficient Data

A seller reviews one week of SQP data and notices a keyword has a low conversion rate. They immediately add it as a negative keyword in all campaigns, or they slash the budget for a keyword that saw a one-week dip in performance.

Why it’s a problem

- Amazon data shifts constantly due to seasonality, competitor activity, and timing.

- A 7-day snapshot is too small to base big decisions on—it’s like forecasting weather from one cloudy day.

- Cutting keywords too soon can kill off profitable ones before they prove their value.

Mistake 3: Operating in a Data Silo

A seller analyzes their SQP report in complete isolation. They see a high click-through rate but low conversion for a keyword and immediately assume the listing content is the problem, without checking other crucial data points.

Why it’s a problem

- SQP data shows what happened, not always why it happened.

- Low conversions may stem from stockouts, competitor pricing, or shipping delays.

- Without checking inventory, pricing, and ad reports, your insights are just guesses.

Mistake 4: Confusing Correlation with Causation

A seller sees that their brand’s purchases for the query “eco-friendly soap” went up in the same week they added the term “eco-friendly” to their title. They conclude the title change caused the increase.

Why it’s a problem

- Sales spikes aren’t always caused by title changes alone.

- External factors like media coverage, competitor stockouts, or new reviews can impact results.

- Misattributing success risks repeating ineffective tactics and missing real growth drivers.

Best Practices for Accurate SQP Analysis

1. Establish a Consistent Reporting Cadence

A seller downloads their SQP report and immediately sorts by impression volume. They pour their entire focus and budget into the top 5-10 keywords with massive search traffic, like “water bottle” or “yoga mat.”

Why it’s a problem

- High-volume keywords are costly and competitive.

- They drive impressions but usually have low CTR and conversions due to broad intent.

- Ignoring long-tail keywords means missing out on higher-converting, more profitable traffic (e.g., “32 oz insulated water bottle with straw lid”).

2. Segment and Prioritize Your Keywords

Don’t treat all keywords equally. Group them into strategic categories:

- Branded Keywords

Terms that include your brand name (e.g., “My Amazon Guy coffee mug”).

- Core Non-Brand Keywords

High-volume, primary terms for your product category (e.g., “coffee mug”).

- Long-Tail Keywords

Highly specific, multi-word phrases (e.g., “16 oz ceramic coffee mug for dad”).

- Competitor Keywords

Terms that include a competitor’s brand name.

By analyzing performance within these segments, you can allocate your budget more effectively and set realistic performance goals for each type of keyword.

3. Cross-Reference with Other Data Sources

Break down the data silos. When you analyze your SQP report, have these other reports open:

- Advertising Reports

How does a keyword’s conversion rate in the SQP report compare to its Advertising Cost of Sales (ACoS) in your PPC campaigns?

- Business Reports

Did a dip in sales for a keyword correlate with a period of being out of stock?

- Pricing and Promotion History

Did a spike in conversion happen when you were running a coupon?

Connecting these dots turns your data from a simple report into a cohesive story about your business performance.

When to Partner with an Amazon Agency

Interpreting data correctly and executing a holistic strategy takes time, expertise, and resources that many sellers don’t have internally. Partnering with a dedicated Amazon agency can bridge this gap.

An experienced agency avoids these common mistakes by default. They bring a team of specialists who:

Provide Expert Interpretation

Agencies have analyzed thousands of SQP reports across hundreds of accounts. They can quickly distinguish a meaningful trend from statistical noise and identify opportunities a seller might miss.

Utilize Advanced Tools

Agencies often subscribe to sophisticated third-party software that can aggregate and visualize data from multiple sources, making it easier to spot correlations and develop effective strategies.

Develop a Holistic Strategy

An agency doesn’t just look at your SQP report. They integrate those insights with PPC management, inventory planning, listing optimization, and brand management to create a comprehensive growth plan.

Amazon Search Query Performance Report FAQs

How do I access the Search Query Performance report?

You must be a brand-registered seller. You can find the report in Seller Central by navigating to the "Brands" menu and selecting "Brand Analytics." The Search Query Performance report is a dashboard within this section.

How often is the data in the SQP report updated?

The data is typically available on a weekly, monthly, and quarterly basis. It is not real-time, so there is usually a delay of a few days before the most recent data appears. For this reason, it is best used for strategic analysis rather than daily tactical changes.

What is the difference between the SQP report and the Search Term report in advertising?

The Search Term report in the advertising console only shows data for traffic that came from a paid ad click. The SQP report shows performance data for all searches, including organic traffic. This gives you a complete picture of your performance on Amazon, not just your advertising results.

Can I see competitor data in the SQP report?

You cannot see specific competitor product data. However, the report gives you your brand's "share" of total clicks and purchases for a given query. By subtracting your share from 100%, you can understand the total market share held by all of your competitors combined for that specific search term.

Your Data, Your Action Plan

The path to scaling your brand isn’t hidden in a secret course; it’s written in your own data. The Search Query Performance report provides the map. All you have to do is take action.

- High Impressions, Low CTR? Fix your main image and title.

- High CTR, Low Conversion? Optimize your A+ Content and reviews.

- High-Converting Keywords? Move them into your title and PPC.

- High Cart Abandonment? Check your final price and shipping speed.

- Losing Brand Share? Increase ad pressure on key terms.

- Wasted Clicks? Add the query as a negative keyword.

- New Customer Language? Use their words in your listing.

- Related Product Searches? Validate ideas for new items.

- Strong Brand Halo? Create smart product bundles.

From Data To Dollars

Our team avoids common interpretation errors by translating your raw SQP data into a clear, actionable strategy for market share growth.