Amazon Fragrance Brand Management Full Service

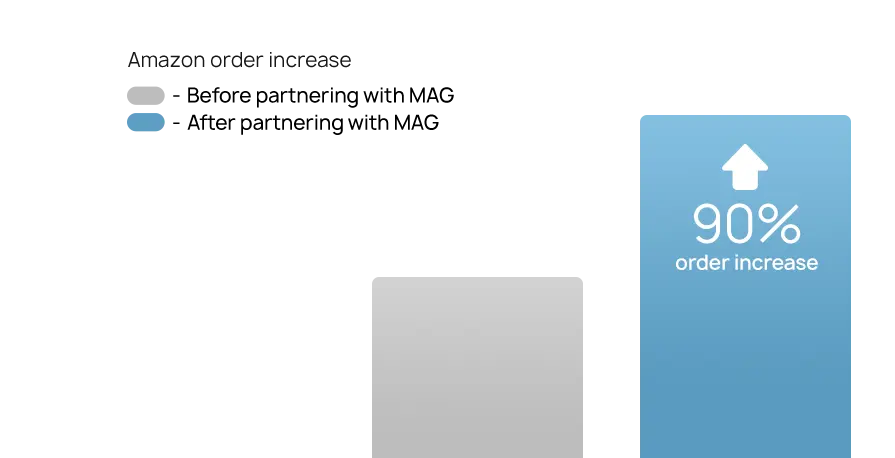

90% Order Increase

Men’s fragrance purchases rose by 90% following the initial strategic overhaul.

To combat declining Vendor Central sales, the client leveraged our expert Amazon Fragrance Brand Management to migrate their catalog to Seller Central, regaining control over pricing and inventory while revitalizing listings with high-converting creative. Beyond stabilizing operations, we navigated complex trademark suppressions to reinstate best-sellers and launched higher-margin bundles, successfully positioning the brand for long-term profitability.

The Challenges

Unprofitable Vendor Agreements

Selling perfume and cologne on Amazon via 1P eroded margins, as algorithms forced prices below sustainable levels.

Missing Expert Oversight

Without Amazon Fragrance Brand Management, technical errors like “meltable” flags went unresolved for months on end.

Constant Ad Suppressions

Automated bots frequently flagged “impression” scents for trademark risks, removing top sellers and disrupting revenue.

Restrictive Hazmat Limits

Strict “dangerous goods” storage caps blocked FBA shipments, causing painful stockouts during critical holiday peaks.

Dormant Advertising Strategy

The account had no active ad campaigns, leaving the brand invisible to new customers while competitors seized market share.

Outdated Visual Assets

Listings featured obsolete imagery that failed to showcase product value or distinguish mist formats from perfumes.

Fragmented Catalog Structure

Disorganized listing variations and “orphaned” products confused shoppers and diluted the organic ranking of top scents.

Stalled New Launches

Technical documentation gaps and backend errors delayed critical product releases, causing the brand to miss growth targets.

Persistent Technical Friction

Ongoing backend errors and barcode conflicts continued to hamper scalability, requiring constant, resource-heavy troubleshooting.

- Full Service

- Catalog Management

- Listing Optimization

- New Product Creation

- Parentages

- Listing Reinstatement

- Social Posts

- Amazon PPC

- Amazon SEO

Our Approach

2023: Foundational Assessment and Strategic Planning

In late 2023, we initiated a comprehensive audit to dismantle the bottlenecks caused by the Vendor Central model. Our team identified that a shift to Seller Central was necessary to regain pricing power and resolve the inventory stagnation preventing growth.

Catalog and Logistics Evaluation

- Analyzed historical performance to pinpoint where algorithm-driven pricing eroded profitability

- Identified specific operational hurdles related to Amazon FBA hazmat requirements for fragrances that prevented bulk stocking during peak seasons

- Designed a phased roadmap to transition key best-sellers from Vendor Central to Seller Central without losing sales history or organic ranking

2024: Migration, Compliance, and Creative Overhaul

We executed the full migration to Seller Central, allowing the brand to dictate its own pricing and margins. Simultaneously, we deployed expert Amazon fragrance brand management to overhaul the visual identity and navigate complex dangerous goods compliance, ensuring products remained purchasable year-round.

Logistics and Compliance Resolution

- Established a dual FBA/FBM logistics model to bypass storage limits for flammable inventory

- Corrected erroneous “meltable” and “dangerous goods” flags that had previously stranded inventory

- Finalized trademark protections to gain access to advanced selling tools and specialized support teams

Creative and Catalog Optimization

- Consolidated fragmented listings into cohesive parent families to aggregate reviews and boost conversion rates

- Replaced outdated photography with high-definition lifestyle images and infographics that clearly communicated scent profiles

- Rewrote titles and bullet points to target high-volume sensory keywords while strictly adhering to fair-use policies for “impression” scents

Advertising Launch

- Built the account’s first structured PPC campaigns to defend branded terms and conquer competitor keywords

- Launched engaging video assets to demonstrate product value and differentiate mist formats from perfumes

2025: Profitability, Defense, and Advanced Scaling

With the foundation secure, we pivoted to aggressive margin optimization and defensive strategies. We focused on reducing reliance on low-ticket single items by introducing higher-value bundles and relentlessly fighting algorithmic suppressions to maintain uptime.

Profitability and Merchandising

- Created multi-pack and gift set listings to increase average order value and offset fulfillment fees

- Adjusted retail pricing on Seller Central to account for storage fees and ensure healthy margins on every unit sold

- Replicated successful US strategies in international marketplaces to capture untapped demand with high efficiency

Listing Defense, and Sustainability

- Successfully appealed and reinstated “Hero” products mistakenly flagged by bots for intellectual property violations

- Ramped up inventory and ad spend ahead of major gifting holidays to capture maximum market share during peak traffic

- Maintained rigorous monitoring of policy compliance to prevent future disruptions to the catalog

2026: Event Optimization and Profit Guard

Tackled eroding margins and stalled launches with BFCM/Prime Day prep. Streamlined troubleshooting for persistent friction to ensure smooth scaling.

Event Campaign Execution

- Prepared PED discounts, coupons, and budget shifts for peak traffic capture

- Monitored FBA restocks and removal orders to avoid inventory shortages

Ongoing Troubleshooting

- Resolved shipment discrepancies and inbound errors via proactive case management

- Reorganized Brand Store PDPs and shipping templates for conversion efficiency

Impact

Men’s fragrance purchases up 90%

This category-specific growth was achieved through the strategic overhaul executed by our Amazon Agency for beauty and fragrance brands during the project timeline.

$365K+ total sales

In November 2024, the brand surpassed previous benchmarks by generating over $365,000 in total sales, establishing a new high-water mark for holiday performance during that period.

See what the right Amazon strategy can do for your business

Partner with experts who know how to drive results.

Amazon Fragrance Brand Management Full Service

90%

Industry:

Location:

Get immediate help from Amazon experts

Is there something you can’t figure out about Amazon? Our top Amazon experts are also available for coaching calls, and can assist you with a wide range of topics. Book a coaching call.

Amazon case studies

We work hand in hand with Growth to create tailor-made strategies that help drive growth on Amazon.