Home Organization Amazon Strategy Full Service Case Study

$1.6 Million Surge

Strong Q3 YoY growth within the first year of partnership with MAG

This home organization brand began in a small Los Angeles apartment, inspired by a genuine need to maximize limited living space. A former theme park engineer applied his creative background to reimagine how functional furniture could fit into tight quarters.

Lacking room for a traditional nightstand, he designed a unique floating shelf concept that found immediate success on Kickstarter. The company now holds over three patents and has developed more than ten product versions to optimize small space living.

The Challenges

Inefficient Global Ad Spend

High global ad costs eroded margins, signaling the urgent need for a unified home organization Amazon strategy to control spend.

Fragmented International Catalog

Broken variations and poor translations in EU markets created disjointed listings that confused shoppers and hurt conversion rates.

Missed Seasonal Momentum

They lacked a playbook on how to market dorm room essentials on Amazon, causing them to miss critical organic ranking opportunities.

Recurring Catalog Instability

Frequent parentage breakages and technical errors disrupted visibility, making listing management a constant, reactive battle.

Costly Packaging Inefficiencies

Unexpected “Ships in Own Container” fees and dimensional errors inflated costs, threatening the product line’s long-term viability.

Persistent Reseller Hijacking

Unauthorized sellers frequently seized the buy box, diluting brand control and complicating pricing management strategies.

Inconsistent Brand Identity

Conflicting brand names across product lines confused the algorithm, hindering efforts to solidify a home organization Amazon strategy.

Rising Returns Impact

Spikes in return fees and unclear disposition data created unpredictable expenses that silently ate into the brand’s bottom line.

- Full Service

- Catalog Management

- Listing Optimization

- New Product Creation

- Parentages

- Listing Reinstatement

- Social Posts

- Amazon PPC

- Amazon SEO

Our Approach

2023: Catalog Stabilization Foundational Work and International Alignment

In 2023, the primary objective was to repair the fragmented infrastructure that was hindering global performance. We focused on unifying the home organization Amazon strategy across North American and European marketplaces, ensuring that the catalog foundation was stable enough to support future scaling efforts without technical disruptions.

Catalog and Variation Repair

- Consolidated broken parent-child variations to aggregate reviews and improve shopper navigation

- Resolved persistent “Ships in Own Container” (SIOC) attributes and dimensional errors that were artificially inflating fulfillment fees

- Standardized product attributes across regions to ensure a consistent customer experience

International Localization

- Audited European listings to correct poor machine translations that confused local shoppers

- Implemented native keyword research for UK, German, and French markets to capture relevant search traffic

- Aligned “Item Type Keywords” across international storefronts to ensure products appeared in the correct browse nodes

2024: Seasonal Dominance and Profitability Scaling

During 2024, the focus shifted toward aggressive seasonal capture and rigorous margin protection. We deployed a specialized “Dorm Dashboard” to dominate the back-to-school season while simultaneously executing a strict methodology for reducing ACOS for furniture accessories on Amazon to improve overall account health.

Seasonal Search and SEO

- Deployed a “Dorm Dashboard” to track and rank for high-volume seasonal keywords like “dorm essentials” and “college must-haves

- Executed a multi-phase SEO update (Phases 1-4) to systematically refresh titles, bullets, and backend search terms

- Optimized “Main Images” through A/B testing to increase Click-Through Rates (CTR) during high-traffic periods

Advertising Efficiency

- Implemented “Dayparting” strategies to pause ad spend during historically low-conversion hours

- Applied aggressive negation tactics to cut wasted spend on underperforming broad match terms

- Restructured campaigns to focus budget on high-margin ASINs while pulling back on low-inventory items

2025: Brand Unification and Asset Consolidation

Moving into 2025, the strategy evolved to address brand identity conflicts and inventory fluidness. We worked to streamline the brand presence to satisfy Amazon’s algorithm and implemented defensive measures to mitigate rising long-term storage costs.

Brand Identity and Protection

- Initiated a full catalog update to unify conflicting brand names and resolve trademark inconsistencies

- Audited A+ Content and Brand Story modules to ensure all assets met “Premium” standards and reduced rejection rates

- Monitored and removed unauthorized third-party changes to listing content to maintain brand integrity

Inventory and Category Management

- Strategized ad spend to accelerate sales velocity for items approaching Long Term Storage Fee (LTSF) windows

- Refined category nodes (e.g., switching from generic furniture to specific “Nightstand” categories) to improve organic relevance

- Developed “bundle” strategies to increase average order value and move complementary inventory faster

Impact

More than $1.6 million sales lift in the first year

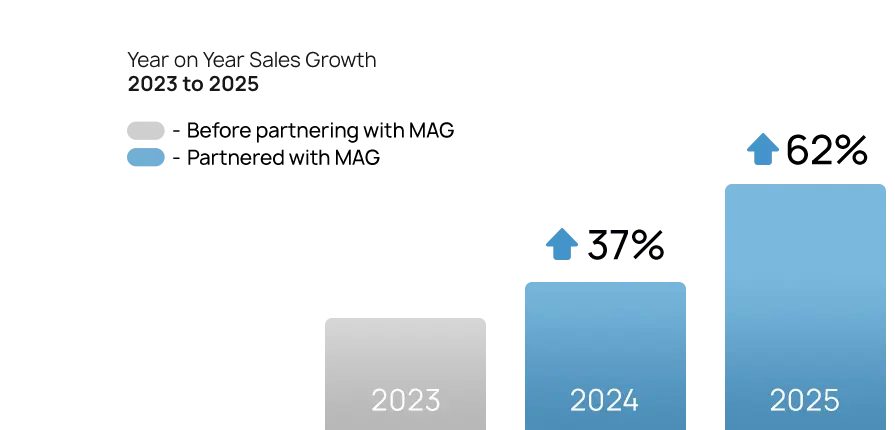

Partnering with the Amazon agency for home organization brands drove progressive Q3 growth: +37% from 2023 to 2024, then +62% from 2024 to 2025 amid peak seasonal surges.

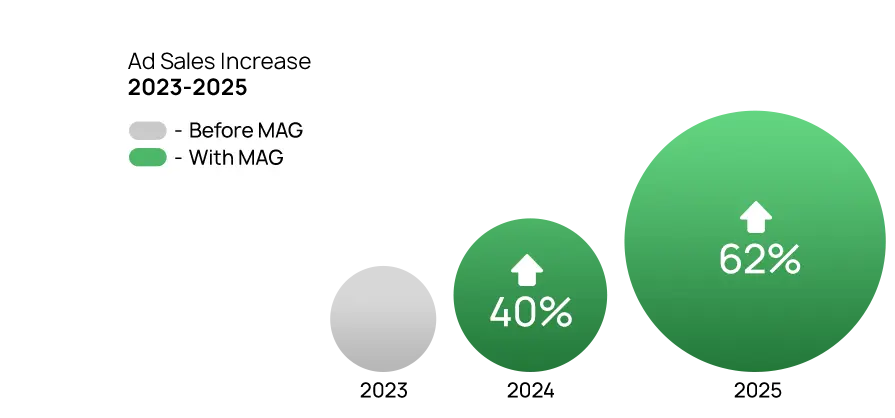

Q3 ad sales surged progressively

Achieved +45% Q3 YoY ad sales growth from 2023-2024 and +70% from 2024-2025, consistently holding TACOS below 10% as a proven efficiency benchmark.

See what the right Amazon strategy can do for your business

Partner with experts who know how to drive results.

Home Organization Amazon Strategy Full Service Case Study

$1.6M

Industry:

Location:

Get immediate help from Amazon experts

Is there something you can’t figure out about Amazon? Our top Amazon experts are also available for coaching calls, and can assist you with a wide range of topics. Book a coaching call.

Amazon case studies

We work hand in hand with Growth to create tailor-made strategies that help drive growth on Amazon.