Turn lost inventory into found profits with Amazon Reimbursement!

The Amazon reimbursement process is complex and bureaucratic, often leaving sellers frustrated and unsure of how to recover their losses. Without a clear understanding of the policy, you might find yourself stuck in uncertainty.

Even when successful, the slow and arduous process can waste valuable time and resources. The worst part is Amazon’s mysterious reimbursement policy, making it hard to know what to expect or how to get reimbursed.

That’s why we’ve created this ultimate guide to Amazon reimbursement, featuring the processes and insights we follow here at our Amazon Agency, to help you master the process and get paid back for what you deserve.

What are Amazon FBA Reimbursements?

Here’s a short sample scenario to illustrate how crucial Amazon reimbursements are to a seller:

Scenario:

John is an Amazon seller who sells electronic accessories online. He has been selling on Amazon for a few years and has built a loyal customer base. One day, he receives an email from Amazon informing him that they will be reimbursing him for a lost shipment of 100 units of his best-selling product.

Reimbursement Details:

- Reimbursement amount: $1,000

- Reason for reimbursement: Lost shipment

- Date of reimbursement: March 15, 2023

Question: How should John record this reimbursement in his accounting records?

Answer: John should record this reimbursement as a recovery of lost income, not as a sale. This is because the reimbursement is not a new sale, but rather a recovery of income that was lost due to the shipment being lost.

Correct Accounting Entry:

Debit: Cost of Goods Sold (COGS) – $1,000 Credit: Accounts Receivable (Amazon) – $1,000

Why: By recording the reimbursement as a recovery of lost income, John is accurately reflecting his business’s true financial position. This ensures that his financial statements are accurate and compliant with accounting standards.

Additional Tip: John should also track this reimbursement in his accounting records to ensure that he is treating these amounts correctly from a tax perspective.

How do I get reimbursement from Amazon?

How to find Amazon reimbursements?

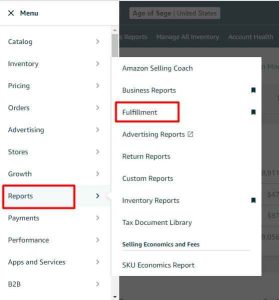

Via Amazon Fulfillment Reports

- In your Seller Central account, navigate to Reports > Fulfillment.

- Look for “Reimbursements” under “Payments” in the left panel menu.

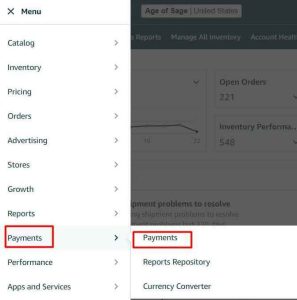

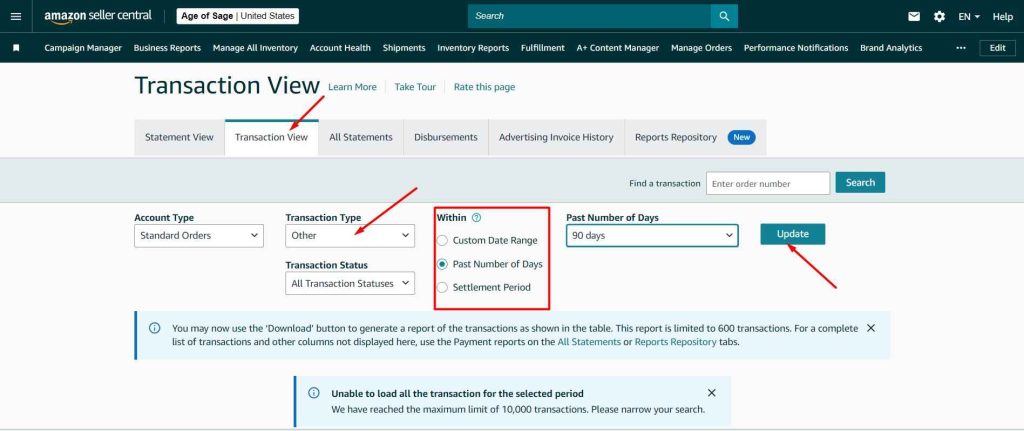

2. Via the Payments Dashboard

- In Seller Central, navigate to “Payments” then click ‘Payments’

- Choose “Transaction View” and filter the ‘Transaction Types’ to ‘Other’

- Set the date according to Custom Date Range, Past Number of Days, or Settlement Period then hit the “Update” button

Does Amazon do reimbursement?

Yes, Amazon provides reimbursement to FBA sellers for various issues that occur during its logistical operations or administrative errors. The following types of incidents are reimbursable:

- Lost Inventory: Inventory lost in Amazon fulfillment centers or during transit to customers.

- Destroyed Products: Products destroyed or discarded without permission.

- Refund Overcharges: Accidental refunds to customers for more than the original purchase price.

- Commission Overcharges: Errors in commission fee charges.

- Product Weight and Dimension Overcharges: Inaccurate measurements leading to overcharging for shipping/storage.

- Damaged Returns: Damaged products during customer returns.

- Lost Removal Orders: Misplaced inventory removal orders.

- Chargebacks: Unrefunded chargebacks.

- Missing Refunds: Missing refunds after 45 days.

- Reimbursement Errors: Partial payment of owed refunds.

These reimbursements are categorized into specific types of incidents, including:

- Lost Inventory

- Damaged Inventory

- Incorrect Fees

- Shipment Discrepancy

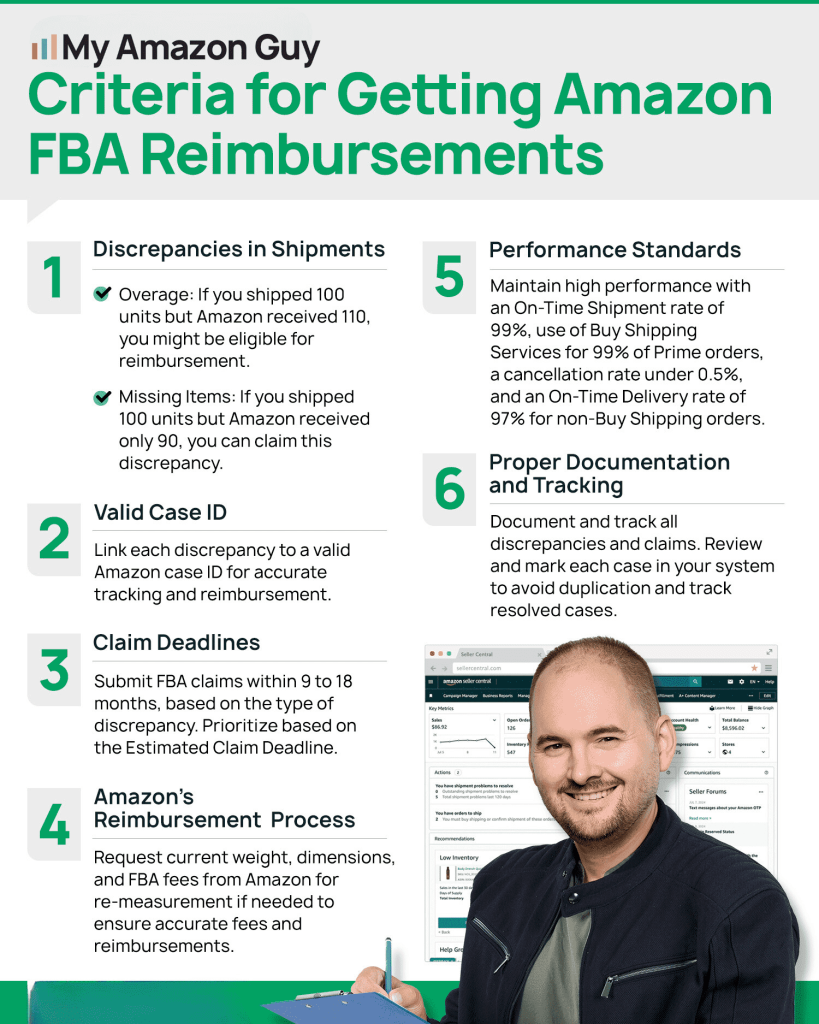

To qualify for a reimbursement, the issue must be clearly due to Amazon’s logistical operations or administrative errors, not seller errors or external factors.

How does Amazon reimbursement work?

A seller must familiarize with the process and time frames that apply to each category of Amazon reimbursements

Lost Inventory

If your inventory is lost within Amazon’s fulfillment centers or during transit, you can file a claim for reimbursement. Follow these steps:

Step 1: Verify the Loss

- Use Amazon’s Inventory Reports in Seller Central to confirm the missing inventory.

Step 2: How to file a claim on Amazon?

- Submit a reimbursement request through the Case Log in Seller Central.

- Provide necessary documentation, including proof of shipment and tracking information, and inventory records showing the discrepancy.

Step 3: Follow Up

- Monitor the status of your claim and respond to any additional requests from Amazon.

Damaged Goods

How des it work to get a refund from Amazon for damaged goods?

If your goods are damaged while under Amazon’s control, including within fulfillment centers or during delivery, you can claim a reimbursement. Follow these steps:

Step 1: Document the Damage

- Collect evidence of the damage, such as:

- Photographs

- Condition notes from Amazon

- Customer feedback

Step 2: Submit a Reimbursement Request

- File the claim through Seller Central.

- Attach all relevant evidence to support your claim.

Step 3: Monitor the Claim

- Keep track of the claim’s progress.

- Respond promptly to any requests for additional documentation or clarification.

Fee Overcharge

If Amazon charges more than expected fees due to weight misclassification or incorrect fee assessment, you can request a review and correction. Follow these steps:

Step 1: Review Your Account

- Regularly check your FBA Fee Details Report in Seller Central for any discrepancies.

Step 2: Submit a Request for Investigation

- If discrepancies are found, file a request through Seller Central to investigate the overcharged fees.

Step 3: Provide Evidence

- Attach evidence, such as:

- Correct dimensions or weight of the product

- To support your claim.

Step 4: Follow Up

- Monitor the investigation’s progress.

- Be prepared to provide additional information if required.

Shipment Discrepancy

How does it work to get a refund from Amazon for shipment discrepancy?

If you’ve shipped more or fewer items to an Amazon warehouse than recorded, you may be eligible for a shipment discrepancy reimbursement. Follow these steps to claim your reimbursement:

Step 1: Document the Shipment

- Keep a detailed record of all items shipped, including:

- Quantities

- Conditions

- Use delivery receipts and shipment tracking as evidence.

Step 2: File a Claim

- Submit a reimbursement request through Amazon Seller Central.

- Provide detailed information about the shipment discrepancy and attach supporting documentation.

Step 3: Follow Up

- Monitor the status of your claim.

- Respond promptly to any additional information requests from Amazon.

- Be prepared to provide further evidence or clarification if Amazon audits the shipment details.

Proper Documentation For Successful Amazon Reimbursement

Having the right documentation is crucial for a successful Amazon reimbursement claim. Here are some key documents:

Proof of Ownership and Inventory

- Purchase orders

These verify that you bought the inventory.

- Invoices

Detailed records of purchases, including quantities and costs.

- Packing slips

Detailed lists of items included in shipments to Amazon.

- Shipping confirmation

Proof of shipments to Amazon’s fulfillment centers.

- Inventory reports

Detailed records of your inventory levels.

Proof of Discrepancies

- Amazon’s inventory adjustment reports

Show discrepancies in your inventory.

- Customer returns

Proof of returned items and associated fees.

- Shipping carrier documentation

Evidence of lost or damaged shipments.

- Product images

Visual proof of product condition or defects.

- Customer communication

Emails, chat logs, or phone records related to issues.

Financial Records

- Sales reports:

To verify sales and revenue.

- Fee statements

Detailed records of Amazon fees.

- Bank statements

To track payments and refunds.

Remember: The specific documents required may vary depending on the type of reimbursement claim you’re filing. It’s always a good practice to maintain detailed records of your Amazon business operations.

Finding Potential Amazon Reimbursements

There are various places to look in your Seller Central account to identify potential Amazon FBA refunds.

Lost or Damaged Products

To determine if and when Amazon lost or damaged your products, check the following Seller Central reports:

- Inventory Adjustments. Identify the date and adjustment cost of a lost or damaged product.

- Manage FBA Inventory. Make sure a lost or damaged item was not found and is still sellable, or the damage was not caused by Amazon.

- Reimbursements. Search by FNSKU and date to ensure you haven’t already received Amazon FBA refunds for lost or damaged goods.

Incorrect Returns

Customer returns that are miscredited, lost, or otherwise mishandled are a prime source for Amazon FBA returns. These return issues include:

- Reimbursements for returns owed to you but not paid

- Customers who receive refunds without returning the products

- Customer refunds issued higher than the original charges

- Wrong and damaged returns

- Late returns that shouldn’t be accepted

To find potential Amazon FBA refunds, review your Seller account to identify anything amiss regarding returns and refunds.

Destroyed Unsellable Inventory

Amazon can destroy and dispose of any inventory it considers unsaleable without your approval and even without notifying you. So the only way to know if Amazon has destroyed or disposed of items in your inventory is to continually review your Seller account.

Incorrect Storage Charges

Amazon FBA storage charges are based on product dimensions. If Amazon assigns a heavier and larger weight to a product, that can result in an overcharge.

Compare the manufacturer’s listed product dimensions to Amazon’s. And, yes, you have to do that comparison for all your SKUs.

Amazon Reimbursement Transactions In Your Seller Statement

- FBA Inventory Reimbursement Customer Return – Compensation for an item damaged while in Amazon’s possession

- FBA Inventory Reimbursement Damaged: Warehouse – Compensation for inventory damaged during warehouse storage

- FBA Inventory Reimbursement Lost: Inbound: Compensation for inventory lost or damaged in transit

- FBA Inventory Reimbursement Lost: Warehouse: Reimbursement for inventory lost in the warehouse

- REVERSAL_REIMBURSEMENT: When Amazon takes back the cash payment for a previous reimbursement and gives you inventory instead

- WAREHOUSE_DAMAGE: Compensation for an item you send to Amazon’s warehouse that gets damaged

Amazon Reimbursement Policy

Amazon reimbursement policies change frequently, affecting claim eligibility and processes. Staying updated ensures sellers can maximize reimbursement opportunities and avoid missed claims due to policy changes.

Below are some policies to keep in mind.

FBA inventory reimbursement policy

Amazon will replace or reimburse you for any FBA inventory lost or damaged in their facilities or during shipping.

Eligibility

To qualify for reimbursement, your item must be: correctly registered, compliant with FBA rules, shipped accurately, not canceled or disposed of, undamaged, and your seller account must be in good standing throughout the claim process.

You can file a claim for lost or damaged inventory once it’s flagged for investigation in your shipping workflow. You have nine months to do this after the shipment arrives at the fulfillment center.

Before filing, double-check your shipment details and reimbursement history. If you still believe you’re owed a reimbursement, you can submit a claim through Seller Central.

Provide shipment ID, proof of ownership, and proof of delivery. Amazon will investigate and decide if you’ll receive a replacement or refund.

Fulfillment Center Operations Claims

Before filing a claim:

- Verify the loss or damage details in your Inventory Ledger.

- Confirm the item wasn’t recovered or restored in your Manage FBA Inventory report.

- Check your Reimbursements report for previous reimbursements.

Submitting a claim:

- Provide additional details about the loss or damage when requested.

- Use the tool in Seller Central to check eligibility and file a claim for damaged items.

If a customer returns an item, Amazon will either charge the customer and reimburse you if the item isn’t returned within 60 days, or inspect the returned item.

If the item is sellable, you won’t be reimbursed. If the item is unsellable due to Amazon’s fault, you’ll be reimbursed.

However, Amazon won’t reimburse you for customer-damaged, recalled, defective, or policy-violating items.

To be eligible for reimbursement, the item must have been lost or damaged by Amazon or its carrier during the removal process. The damage or loss must have occurred after the item left the Amazon facility, and you must not have violated any Amazon policies.

Policy Update

Amazon is shortening the FBA inventory reimbursement claim window from 18 months to 60 days starting October 23, 2024, excluding shipment-to-Amazon claims.

What is Amazon Reimbursement Limit

Maximum Reimbursement

Amazon caps reimbursements at $5,000 per item. For higher-value items, consider third-party insurance.

Reimbursement Calculation

Amazon determines reimbursement based on an estimated sale price. This is calculated using factors like:

- Your past sales prices

- Other sellers’ prices

- Your current listing price

- Other sellers’ current listing prices

If there’s insufficient data, Amazon may estimate the price based on similar products.

Types of Amazon FBA Reimbursements:

- Shipment to Amazon claims

Reimbursed based on estimated sale price minus fees.

- Fulfillment center operations and removal claims

Reimbursed based on estimated sale price minus fees, unless the item was unsellable. In that case, reimbursement is based on a discounted value.

- Customer return claims

Reimbursed based on the refund or replacement amount given to the customer, minus applicable fees.

Best Practices for Amazon Reimbursements

Record Keeping and Analysis

- Document everything:

Maintain detailed records of inventory, shipments, and deliveries.

- Regularly review inventory

Compare your records to Amazon’s inventory to identify discrepancies.

- Monitor customer returns

Ensure accurate processing and fee waivers for returns.

- Check fee accuracy

Verify that Amazon charges the correct fees.

Claim Preparation and Submission

- Thorough account audit

Analyze key reports like Refund Reports, Inventory Adjustment Reports, and Manage Order Reports to find errors.

- Document issues

Clearly record all discrepancies you identify.

- Allow time for resolution

Give Amazon 30-45 days to correct recent errors before filing a claim.

- Verify eligibility

Ensure you meet Amazon’s reimbursement criteria before submitting a claim.

- Detailed claims

Provide clear and complete information when filing a claim.

- Track claim progress

Monitor your claim’s status for timely resolution.

Utilize Technology and Services

- Consider reimbursement services

Explore services like My Refund Guy to automate the process and potentially increase recoveries.

- Utilize Amazon tools

Take advantage of Amazon’s reporting tools to gather necessary data.

Amazon Reimbursement Accounting

Properly tracking Amazon reimbursements is crucial for maintaining accurate financial records and ensuring tax compliance. By accurately accounting for these funds, sellers can verify they’re receiving all owed money and avoid potential financial and tax issues.

Two common accounting errors related to reimbursements are:

- Misclassifying reimbursements as sales: Treating reimbursements as sales inflates revenue, distorting the business’s financial performance. Reimbursements should be recorded as “other income” as they represent compensation for issues like lost or damaged inventory, not actual sales.

- Incorrect tax treatment: Amazon reimbursements often come without sales tax or VAT. Sellers must carefully consider tax implications based on their specific business structure and location.

Avoiding these mistakes is essential for maintaining accurate financial records and complying with tax regulations.

Amazon Reimbursement FAQs

What is the Amazon Reimbursement Report?

The Reimbursements report provides a detailed breakdown of all reimbursements, both manual and automatic.

How long does Amazon reimbursement take?

It takes 4-5 days for reimbursements to appear in your account after approval.

What is Amazon reimbursement limit?

Maximum Reimbursement: Amazon caps reimbursements at $5,000 per item. For higher-value items, consider third-party insurance.

How does Amazon calculate the amount to reimburse?

Amazon determines reimbursement based on an estimated sale price. This is calculated using factors like:

- Your past sales prices

- Other sellers’ prices

- Your current listing price

- Other sellers’ current listing prices

If there’s insufficient data, Amazon may estimate the price based on similar products.

Reimbursement Types:

- Shipment to Amazon claims: Reimbursed based on estimated sale price minus fees.

- Fulfillment center operations and removals claims: Reimbursed based on estimated sale price minus fees, unless the item was unsellable. In that case, reimbursement is based on a discounted value.

- Customer return claims: Reimbursed based on the refund claim or replacement amount given to the customer, minus applicable fees.

How do I check my reimbursement status on Amazon?

You can see the status and other reimbursement details by opening or downloading the Reimbursements Report in Seller Central.

Reclaim Your Amazon Profits

Amazon reimbursements are often overlooked, leaving sellers with untapped revenue. This guide to Amazon FBA reimbursements equips you with the knowledge and strategies to identify, claim, and recover lost funds.

From understanding reimbursement types to mastering the claims process, we’ve covered essential steps to maximize your returns. Accurate record-keeping, timely actions, and potentially utilizing reimbursement services are crucial.

Don’t let Amazon profits slip through your fingers. Contact our Amazon agency today for expert assistance in recovering your hard-earned money.